Does a Car Need to Be Registered to Get Insurance? Explained!

Understanding Car Insurance Requirements

Car insurance requirements vary significantly from state to state, reflecting local laws and regulations. Each state mandates a minimum level of coverage that drivers must carry to legally operate a vehicle. Understanding these requirements is crucial for ensuring compliance and protecting yourself financially in the event of an accident.

Types of Required Coverage

Most states require at least some form of liability insurance, which typically includes two main components:

- Bodily Injury Liability: This covers medical expenses and lost wages for other parties if you are at fault in an accident.

- Property Damage Liability: This pays for damages to another persons property, such as their vehicle or home, resulting from an accident you caused.

In addition to liability insurance, some states may also require drivers to carry additional coverage types, such as Personal Injury Protection (PIP) or Uninsured/Underinsured Motorist coverage. PIP covers medical expenses for you and your passengers, regardless of who is at fault, while Uninsured/Underinsured Motorist coverage protects you if you’re in an accident with a driver who lacks sufficient insurance.

Penalties for Non-Compliance

Failing to meet your state’s car insurance requirements can lead to severe consequences. Penalties can include hefty fines, license suspension, and even vehicle impoundment. Furthermore, being caught driving without insurance can result in higher premiums in the future, as insurers may consider you a higher risk. Therefore, it is essential to familiarize yourself with your state’s specific requirements and ensure you have the necessary coverage in place.

Do You Need to Register Your Car for Insurance?

When it comes to insuring your vehicle, one of the first questions you might ask is whether you need to register your car before obtaining insurance. The answer is yes; in most states, you must have your car registered to purchase auto insurance. This requirement ensures that the vehicle you are insuring is officially recognized by the state, making it easier for law enforcement and insurance companies to track ownership and coverage.

Here are some key points to consider:

- Legal Requirement: In many jurisdictions, having a registered vehicle is a legal requirement for driving on public roads. Insurance companies typically require proof of registration to provide coverage.

- Identification of Vehicle: Registration provides essential information about the vehicle, including its make, model, and VIN (Vehicle Identification Number), which are crucial for the insurance policy.

- Policy Activation: Most insurers will not activate your policy until they have verified that the vehicle is registered in your name.

Additionally, having your car registered can also affect your insurance rates. Insurers often consider factors like the vehicles age, type, and safety features—information that is typically obtained through the registration process. If your vehicle is not registered, you may face difficulties in finding an insurer willing to cover it, as unregistered vehicles are seen as a higher risk.

In summary, registering your car is a critical step in securing auto insurance. It not only fulfills legal obligations but also streamlines the process of obtaining coverage. Without registration, you may find it challenging to get the protection you need while driving.

Consequences of Insuring an Unregistered Vehicle

Insuring an unregistered vehicle can lead to a range of significant consequences, both legal and financial. One of the primary issues is that insurance companies typically require proof of registration before issuing a policy. This means that attempting to insure a vehicle that is not registered could result in the denial of coverage, leaving the vehicle owner without the necessary protection in the event of an accident or theft.

Legal Implications

Driving an unregistered vehicle is against the law in most jurisdictions. If caught, the owner may face fines, penalties, or even legal action. Additionally, if an unregistered vehicle is involved in an accident, the driver may be held liable for damages without any insurance coverage to help mitigate those costs. This can lead to severe financial repercussions, including out-of-pocket expenses for repairs, medical bills, and potential lawsuits.

Impact on Future Insurance Options

Insuring an unregistered vehicle can also have long-term effects on a driver’s ability to obtain insurance in the future. If an insurance company discovers that a policy was issued for an unregistered vehicle, they may cancel the policy, which can negatively impact the driver’s insurance record. This can result in higher premiums or difficulty securing insurance altogether, as insurers often view a history of unregistered vehicles as a red flag.

Potential for Increased Liability

Furthermore, insuring an unregistered vehicle can increase liability risks. In the event of an accident, the lack of proper registration can complicate claims processes, making it difficult to receive compensation for damages or injuries. This not only places the vehicle owner at risk but can also have repercussions for other parties involved in an accident, leading to disputes over liability and compensation.

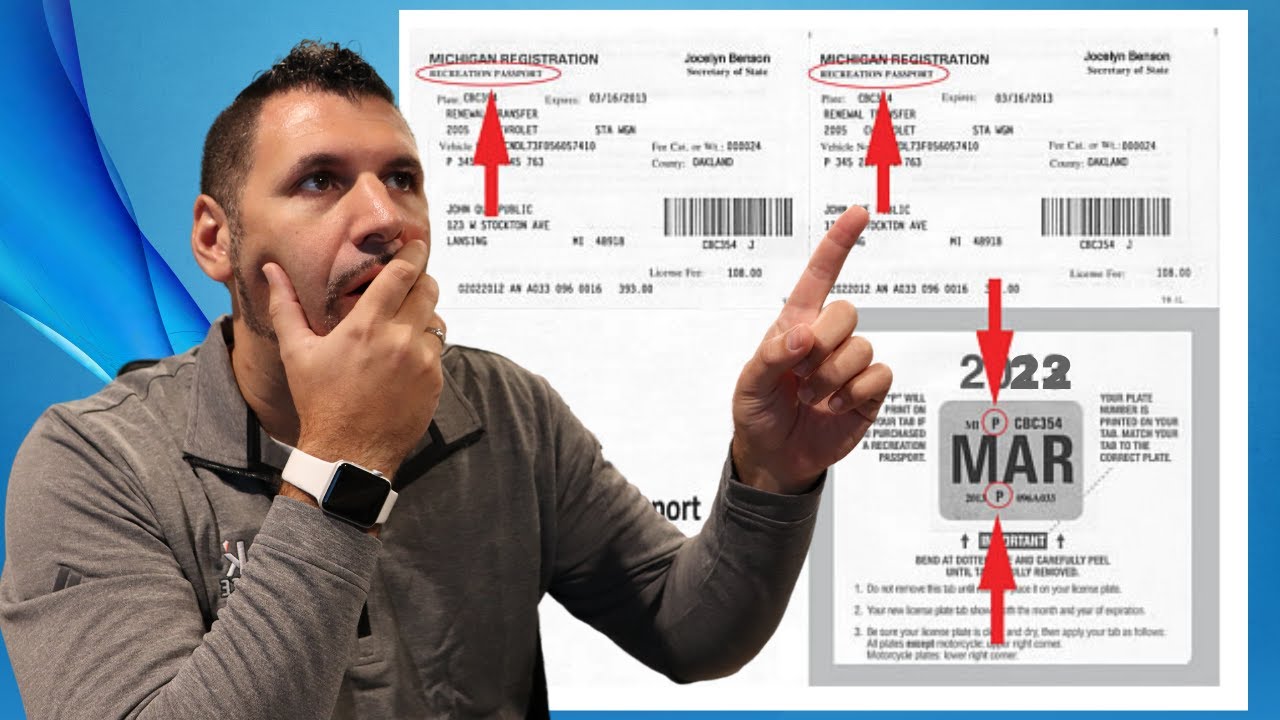

Steps to Register Your Car Before Getting Insurance

When preparing to register your car, it’s essential to follow a structured approach to ensure everything is in order before you secure insurance. The first step in this process is to gather all necessary documentation. Typically, you will need the following:

- Vehicle Title: Proof of ownership is crucial, so make sure you have the title ready.

- Identification: A valid driver’s license or state ID is necessary for identification purposes.

- Proof of Residency: Documents like utility bills or lease agreements may be required to confirm your address.

- Bill of Sale: If you purchased the car from a private seller, a bill of sale can help establish the transaction.

Once you have all the necessary documents, the next step is to visit your local Department of Motor Vehicles (DMV) or relevant authority for vehicle registration. During this visit, you will need to fill out a registration application form and submit your gathered documents. Be prepared to pay any applicable registration fees, which can vary by state and vehicle type.

After your car is registered, you will receive a registration certificate and license plates, which are necessary for legal driving. At this point, you can proceed to obtain car insurance. Most insurance providers will require proof of registration before they can finalize your policy, ensuring that your vehicle is officially recognized and legally on the road.

Frequently Asked Questions About Car Registration and Insurance

What is car registration?

Car registration is the process of officially recording a vehicle with the relevant government authority, typically a department of motor vehicles (DMV) or similar agency. This process ensures that the vehicle is legally recognized for use on public roads. When you register your car, you will receive a license plate and registration card, which serve as proof of ownership and compliance with local laws. It’s important to note that car registration often requires payment of fees and can vary significantly by state or country.

Why is car insurance necessary?

Car insurance is a legal requirement in most places, designed to protect drivers, passengers, and pedestrians in the event of an accident. It provides financial coverage for damages to your vehicle, injuries sustained, and any liability incurred from causing damage to others property. In many jurisdictions, driving without insurance can lead to severe penalties, including fines, license suspension, and even legal action.

How do registration and insurance work together?

Car registration and insurance are closely linked. Before you can register your vehicle, most states require proof of insurance coverage. This means that you need to secure an insurance policy that meets the minimum coverage requirements for your area. Additionally, your insurance company may also require you to provide your vehicle registration details when setting up your policy. It’s essential to keep both your registration and insurance up to date to avoid legal issues and ensure you are protected while on the road.

What should I do if I move to a new state?

If you move to a new state, you will need to update both your car registration and insurance. Most states require you to register your vehicle within a certain timeframe after establishing residency. Additionally, you should notify your insurance provider of your new address, as it may affect your coverage and premiums. Ensure you check the specific registration requirements and insurance laws in your new state to maintain compliance and avoid potential fines.

Did you like this content Does a Car Need to Be Registered to Get Insurance? Explained! See more here General Mechanics.

Leave a Reply